2025 Tax Brackets Mfs. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). As your income goes up, the tax rate on the next layer of income is higher.

Tax brackets and tax rates. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Tax Rates And Brackets Pdf Printable Lora Marlee, The irs has established updated standard deductions based on the newly. Federal 2025 income tax ranges from 10% to 37%.

2025 Tax Brackets Mfs Jorey Malanie, Your bracket depends on your taxable income and filing status. Marginal tax rates chart for 2025.

2025 Tax Brackets Chart Ami Lindsay, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. These brackets apply to federal income tax returns you would normally file in early 2025.) it's also.

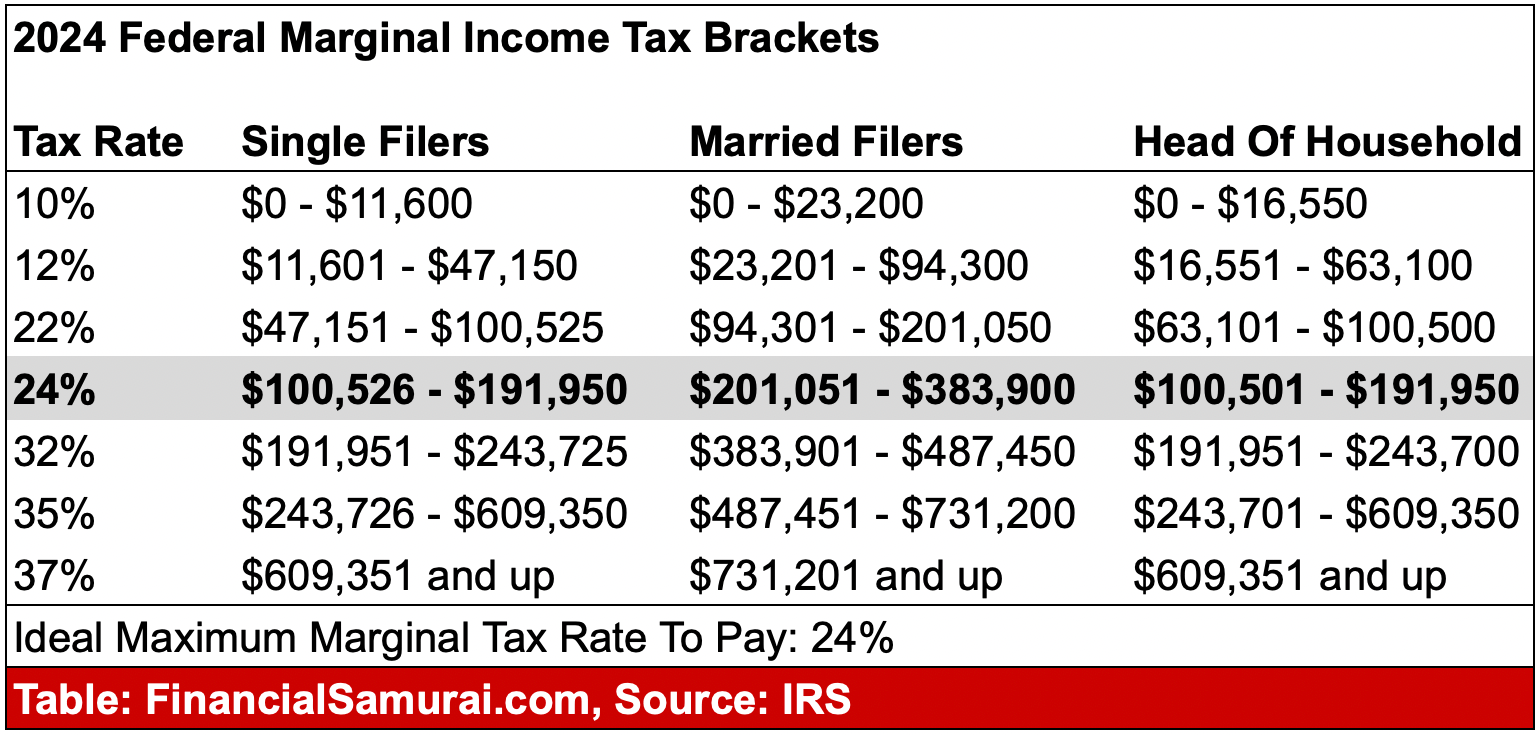

IRS Sets 2025 Tax Brackets with Inflation Adjustments, An individual has to choose between new and. The chart below details some of the various factors that can impact a taxpayer’s marginal tax rate, including both ordinary income tax brackets.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Amounts shown are taxable income, including ordinary income (wages, salaries, interest, etc.) and capital.

Estimated Tax Brackets For 2025 Elna Noelyn, Here we outline the 2025 tax brackets and. See current federal tax brackets and rates based on your income and filing status.

Tax Brackets 2025 Irs Single Linda Tamarra, See current federal tax brackets and rates based on your income and filing status. The mutual fund industry is proposing a 10% tax on debt fund units held over 3 years to encourage retail investor participation.

2025 Tax Brackets Married Filing Separately Nolie Angelita, What are the capital gains tax rates on. The irs has established updated standard deductions based on the newly.

2025 Tax Code Changes Everything You Need To Know, 10%, 12%, 22%, 24%, 32%, 35% and. Your bracket depends on your taxable income and filing status.

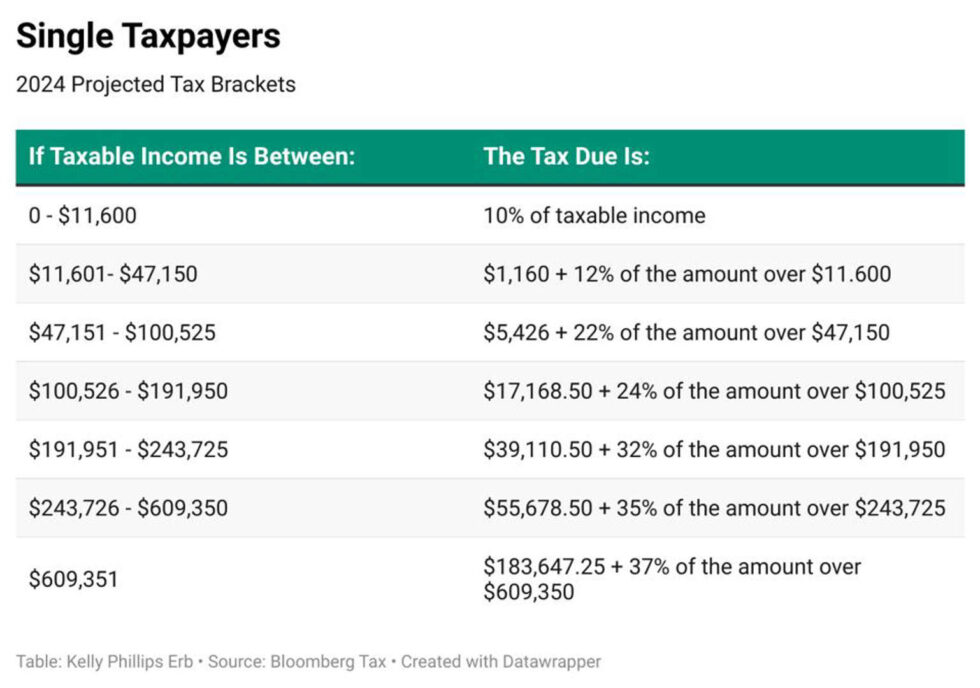

2025 Tax Brackets And The New Ideal Money Wiseup, This page has the latest federal brackets and tax rates, plus a federal income tax calculator. Using the marginal tax rates for the 2025 tax year, your first $11,600 of taxable income is only taxed at the 10% rate.

The chart below details some of the various factors that can impact a taxpayer’s marginal tax rate, including both ordinary income tax brackets.

This means that the standard deduction for single taxpayers and married taxpayers filing separately will be $14,600, head of household will be $21,900, and married filing joint (mfj) will be $29,200.